Accumulated depreciation formula

Subtract the estimated salvage value of the asset from. Second year depreciation 2 x 15 x 900 360.

Accumulated Depreciation Accountingtools India Dictionary

Accumulated Depreciation Cost of Fixed Asset Salvage Value Useful Life Assumption Number of Years.

. An assets carrying value on the balance sheet is the difference between. As the company uses the straight-line depreciation method we can calculate the depreciation of the equipment as below. Additionally the assets average useful life is 5 years.

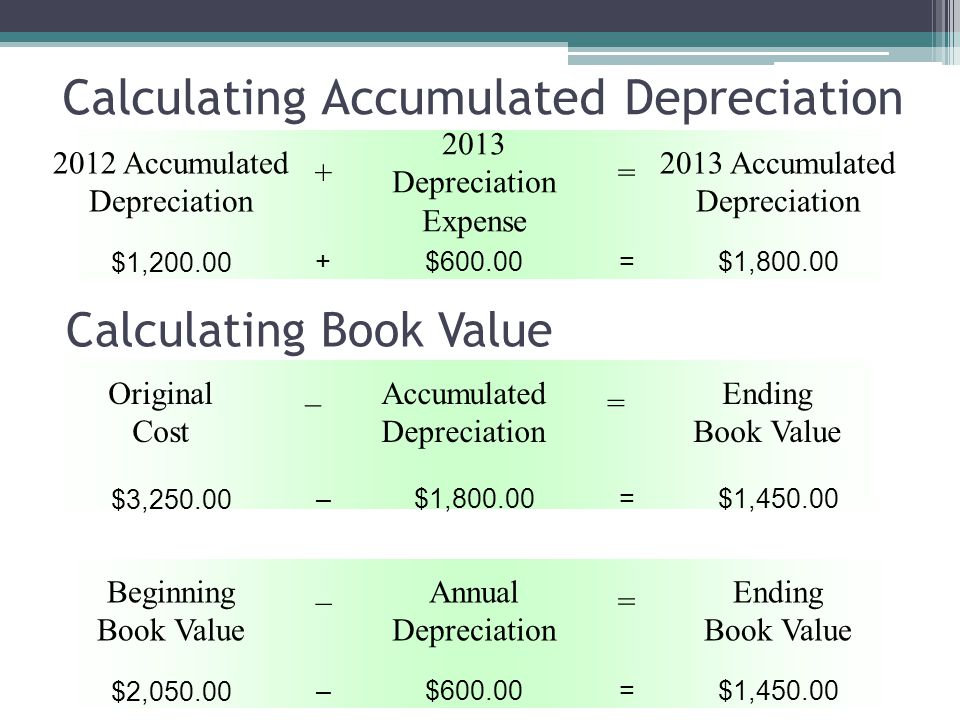

You can calculate subsequent years in the same way with. Here is the formula for calculating accumulated depreciation using the double-declining balance method. Opening balance of accumulated depreciation USDXXX.

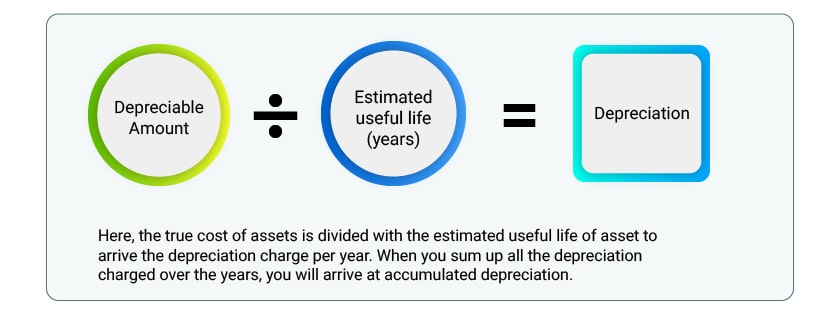

The cost for each year you own the asset becomes a business expense for. The method of the formula used to calculate depreciation is. What is the formula for calculating accumulated depreciation.

So in the second year your monthly depreciation falls to 30. In this case the. There are a few different methods for calculating accumulated depreciation.

Non-ACRS Rules Introduces Basic Concepts of Depreciation. Determine the cost of the asset. Accumulated depreciation is the total amount of depreciation expense recorded for an asset.

One of the most common is. Sum of the years digits SYD method. The straight line calculation steps are.

Depreciation Expense 2 x Basic Depreciation Rate x Book Value. For example lets say an asset has been used for 5 years and has an accumulated depreciation of 100000 in total. Depreciation expenses charge during the yearperiod USDXXX.

Accumulated Depreciation 100000 - 5000 10. A balance sheet lists all the companys assets and categorizes each of them by the type of asset. The accumulated depreciation formula using the straight-line method requires the total expected lifespan of an asset.

Depreciation 5000 5 years 1000 per year. The total depreciation expense allocated to a specific Fixed asset since the asset was used known as. You can use the following basic declining balance formula to calculate accumulated depreciation for years.

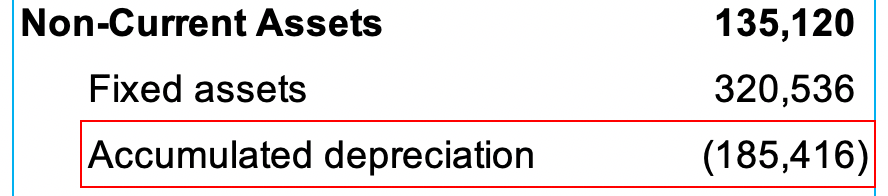

Accumulative depreciation also known as accrued depreciation is a contra-asset account which means a negative asset account that equalizes the total in the asset account to which it is. The final method for calculating accumulated depreciation is the SYD or sum of the years digits. Fixed Assets accumulated depreciation Formula Calculation.

Accumulated depreciation is the cumulative depreciation of an asset up to a single point in its life. Lets say the salvage value in this example is 5000 so the formula for accumulated depreciation becomes. Basic Tax Depreciation Overview Including Depreciation Methods Accounting Procedures.

As a result the accumulated depreciation ratio looks like this. How to Calculate Straight Line Depreciation. Accumulated depreciation is the total decrease in the value of an asset on the balance sheet of a business over time.

Accumulated depreciation is with the assets on a balance sheet. What Is the Basic Formula for Calculating Accumulated Depreciation. Total yearly depreciation Depreciation factor x 1.

After the 5-year period if the company were to sell the asset. The government of Canada divides tangible assets into. This formula looks like this.

Accumulated Depreciation Ratio 76000000 123000000 6178.

Accumulated Depreciation Definition Formula Calculation

:max_bytes(150000):strip_icc()/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-02-b230b73e49c3406ba7b944172f09a624.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Calculator Download Free Excel Template

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition How It Works Calculation Tally

What Is Accumulated Depreciation How It Works And Why You Need It

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Definition Formula Calculation

Accumulated Depreciation Explained Bench Accounting

Straight Line Depreciation Accountingcoach

/dotdash_Final_Why_is_Accumulated_Depreciation_a_Credit_Balance_Jul_2020-01-34c67ae5f6a54883ba5a5947ba50f139.jpg)

Why Is Accumulated Depreciation A Credit Balance

Accumulated Depreciation Overview How It Works Example

Accumulated Depreciation Msrblog

Fixed Assets Accumulated Depreciation Formula Calculation Financial Learning Class

Depreciation Of Fixed Assets Double Entry Bookkeeping

Depreciation Formula Examples With Excel Template

Accumulated Depreciation Calculation Journal Entry Accountinguide